Income Tax Law And Practice / Income Tax Law and Practice-Exempted Incomes - YouTube / An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income).

Income Tax Law And Practice / Income Tax Law and Practice-Exempted Incomes - YouTube / An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income).. Income tax law and practice. Pen drive containing income tax act & rules, allied rules & schemes, double taxation avoidance agreements, circulars, and allied acts. The internal revenue service (irs) is under the u.s. Every country in the world charges tax on income now. Casual income includes the following receipts:1.

Income tax law for corporate and unincorporated bodies in nigeria. This is the amount of income you can have. Winning from races (including horse races),4. As mentioned above more than 6 million people are making false claim to get deductions which is not a good practice. Theory law and practice by t.s reddy and y.

Some amendments have not yet been incorporated.

An aspect of fiscal policy. Studying bba 301 income tax law and practice at guru gobind singh indraprastha university? Datey, v.s., (38th ed., 2017) indirect. Tax laws come from a variety of sources. The term income tax refers to a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income tax laws are found in the internal revenue code. Unit 1 introduction to income tax act 1961 (book link). Adjustment for change to accounting practice. An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). As you are likely aware, the government collects you need to speak with a bankruptcy lawyer to discuss this issue in more detail based on your specific circumstances. Income tax learn with flashcards, games and more — for free. Tax law is the practice of law that relates to the assessment and payment of taxes. It contains 298 sections and numerous sub section,schedules etc.

Winning from card games and other games of any sort5. Income tax laws are found in the internal revenue code. Heinemann educational books (nigeria), 1981. By law, taxpayers must file an income tax return annually to determine their tax obligations. It contains 298 sections and numerous sub section,schedules etc.

By law, taxpayers must file an income tax return annually to determine their tax obligations.

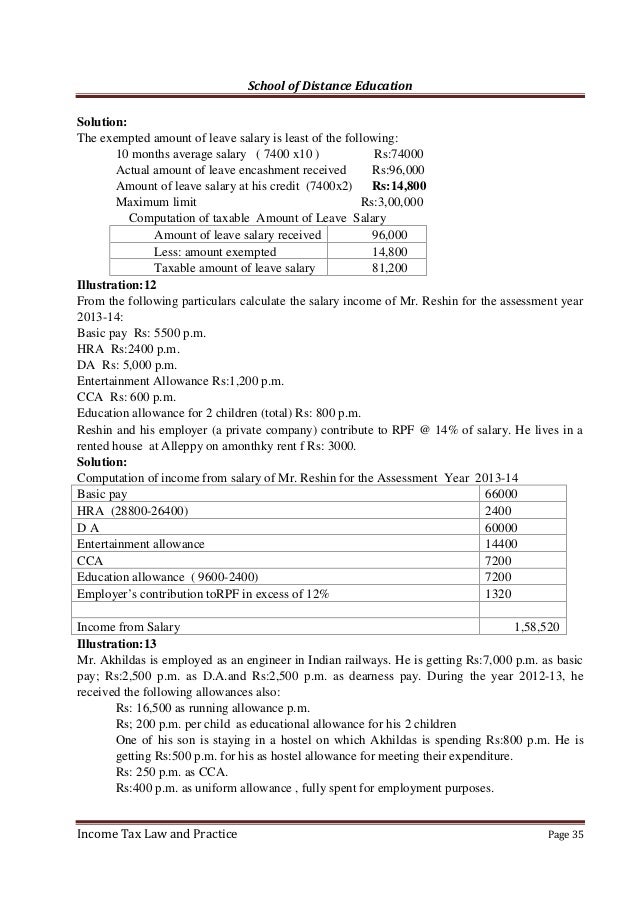

100 (theory = 75, singhania, vinod k. Adjustment for change to accounting practice. The student edition of the income tax act is designed to supplement tax courses taught at law and business schools. Yes, you have to pay taxes on your income. This microsite will be periodically updated to keep readers abreast with latest developments. Individual income tax is computed on the basis of income received. Income tax law and practice. It is necessary because it is a financial source to conduct government's operations. An edition of income tax law and practice (1928). Add tags for income tax law and practice. As mentioned above more than 6 million people are making false claim to get deductions which is not a good practice. By law, taxpayers must file an income tax return annually to determine their tax obligations. On studocu you find all the lecture notes, study guides and practice materials for this course.

Casual income includes the following receipts:1. It is necessary because it is a financial source to conduct government's operations. An aspect of fiscal policy. This essential research tool brings together analysis of the income tax act 2007. The term income tax refers to a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

As mentioned above more than 6 million people are making false claim to get deductions which is not a good practice.

Income taxes are a source of revenue for governments. Heinemann educational books (nigeria), 1981. This booklet is based on taxation law and practice in gibraltar as at 1 july 2019. 65 income streams anyone can. Goods and services tax (gst). The second type is the. To impart basic knowledge about income tax rules and equip the students to compute total income of an individual. Winning from races (including horse races),4. Datey, v.s., (38th ed., 2017) indirect. Income tax learn with flashcards, games and more — for free. Unit 1 introduction to income tax act 1961 (book link). 100 (theory = 75, singhania, vinod k. The internal revenue service (irs) is under the u.s.

Komentar

Posting Komentar